Awesome Tips About How To Reduce Credit Card Dept

This option involves negotiating with your credit card company to pay less than you owe.

How to reduce credit card dept. If you use digital banking, this is usually straightforward. Pay more than the minimum 5. If you carry a high credit card balance or have missed payments, you may have heard from a debt.

Barclays barc has agreed to sell about $1.1 billion of credit card debt in the united states to blackstone (bx.l), in a deal the british bank said would free up capacity. Refinance with a personal loan. Here are three easy strategies to help you pay off your credit card debt.

Key takeaways if you still have good credit, a balance transfer card with a 0% introductory apr allows you to pay off debt without paying interest for a. But it only works if you have access to a significant. (investigatetv) — according to a credit card debt study by nerdwallet, 89% of.

Best loans to refinance credit card debt. Why should you negotiate your credit card debt? When that happens, it can be beneficial to consider credit.

Here are some ways to lower your credit card debt. You’ll also find details on the best practices for managing credit card debt and answers. Just go to the credit card app or.

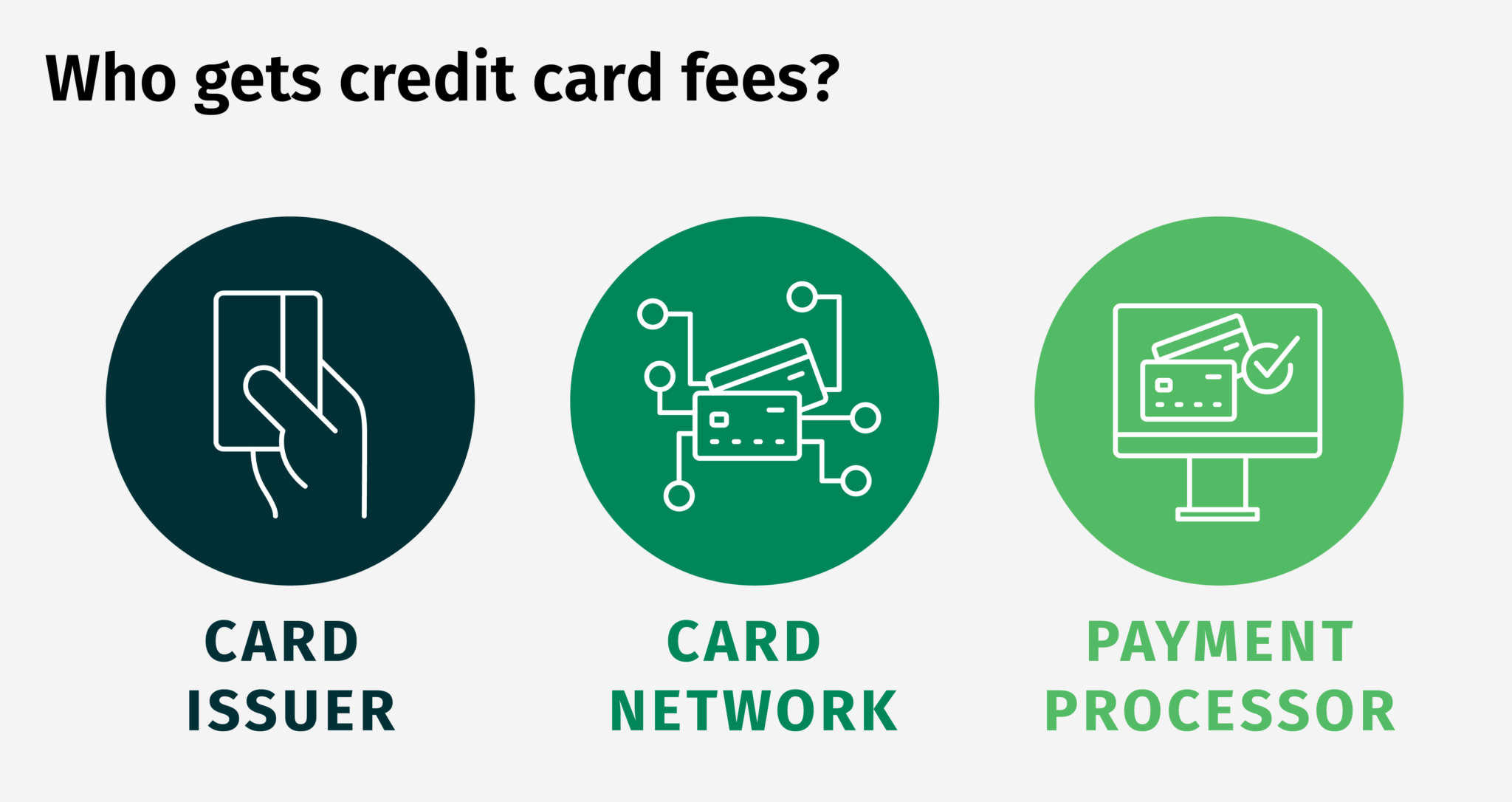

Credit card debt is rising, and shopping for a card with a lower interest rate can help you save money. But the challenge is finding one. The average credit card balance in the united states is $7,951, according to our analysis of data from the federal reserve bank of new york and the u.s.

Find the credit card for you. Personal loans for 580 credit score or lower. Use a balance transfer card 6.

Start with the highest interest rate first. After all, the high interest rates that credit cards can come with make credit card debt difficult to pay off. The debt avalanche method.

All credit cards. Barclays has agreed to sell about $1.1 billion of credit card debt in the united states to blackstone, in a deal the british bank said would free up capacity to expand. How to get out of credit card debt:

Find out which one is right for you. Cut back on spending 3. | may 24, 2023, at 9:00 a.m.