Casual Tips About How To Get A Va Loan With Bad Credit

Still, there are steps you can take to.

How to get a va loan with bad credit. While va loans typically do not require a down payment, making a down payment can help mitigate the risk associated with bad credit. This step lays the groundwork for a successful application for a personal loan with bad credit. However, there are options available for borrowers with bad credit to fund the purchase of their dream home.

Applying for a va home loan. Get the latest mortgage rates for purchase or refinance from reputable lenders at realtor.com®. You can get started, even with not so great credit.

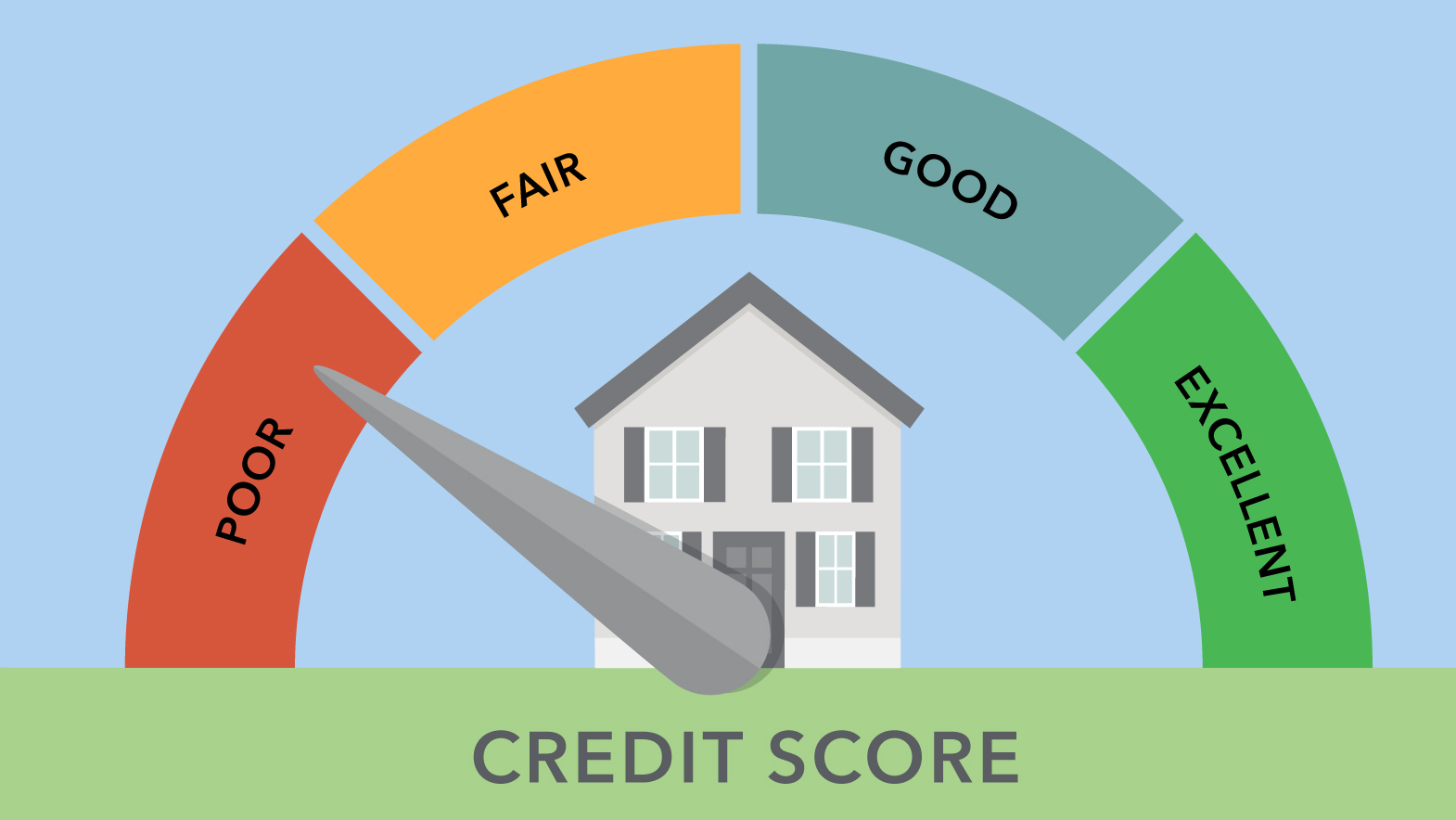

You can start by looking at the fico credit score range chart before you start shopping for a va home loan to get an idea of what a “bad” credit score is: Veterans with poor credit may still qualify. The va has no minimum credit score requirement, and while some mortgage lenders require you to meet a qualifying score, they’re still required to look at your entire financial profile.

Consider a va loan with a down payment: Borrowing more than necessary could lead to unnecessary debt. Advertiser disclosure how to get a va loan with bad credit november 11, 2023 mortgage bad credit can feel like the end of your ability to borrow, especially if you are trying to secure a home loan.

(many of the links in this article redirect to a specific reviewed product. The interest rates are usually better than credit cards too. Before president biden took office, only.

At rocket mortgage, the minimum qualifying credit score is 580. Ways to get a va loan with bad credit: Griffin funding can help you understand your options.

Start by comparing interest rates from various mortgage lenders, including traditional banks, credit unions. By offering a down payment, you may be able to negotiate more favorable loan terms or convince lenders to overlook certain credit issues. Here are some examples of what credit scores some of the top va lenders are looking for in 2024:

Calculate what your monthly payment would look like for each loan (if it wasn’t already provided). However, you may get a better rate by using a cosigner or pledging collateral. Bad credit personal loans are available from lenders like upgrade, upstart, onemain financial and avant.

Work on improving your credit score by paying bills on time, reducing debt, and disputing any errors on your credit report. With the monthly payment in mind, confirm whether you can realistically manage payment in your. The va doesn’t have a minimum credit score requirement — but the lenders who offer va loans do.

At veterans united, we have a 600 fico credit score minimum in most cases. 800 and above very good: Getting a va loan after foreclosure or bankruptcy.