Best Of The Best Tips About How To Fix Debt

Modified on november 21, 2023.

How to fix debt. Consider using a budget tracking app to understand where every dollar goes. If you don't know where to start, call the free national debt helpline on 1800 007 007. Personal finance pay off debt:

The intent is to help you slash mounds of debt. Using a debt management strategy like the snowball method, debt consolidation or taking advantage of financial windfalls can help you get out of debt quicker. Make a list of your debts, including the creditor, total amount of the debt, monthly payment, interest rate, and due date.

If you have to get up early for an appointment on a friday, and then. Tools and tips learn strategies for whittling down what you owe, and get insight into the best approach. Having a concrete repayment goal and strategy will help keep you — and your credit card.

6 ways to get out of debt if. You can use your credit report to confirm the debts on your list. List all your debts from smallest to largest—regardless of interest rate.

The best way to consolidate your debt without hurting your credit is to create a plan and stick to it. Review all your loan statements and bills and fully understand how much debt you owe each month. Budgeting in times of uncertainty what is.

Aboriginal and torres strait islander peoples can call the free mob strong debt helpline on 1800 808 488. A good first step toward getting out of credit card debt is to assess your financial situation. Brock in this article view all stop accumulating debt build an emergency fund use the debt snowball method ask for a lower interest rate increase your income

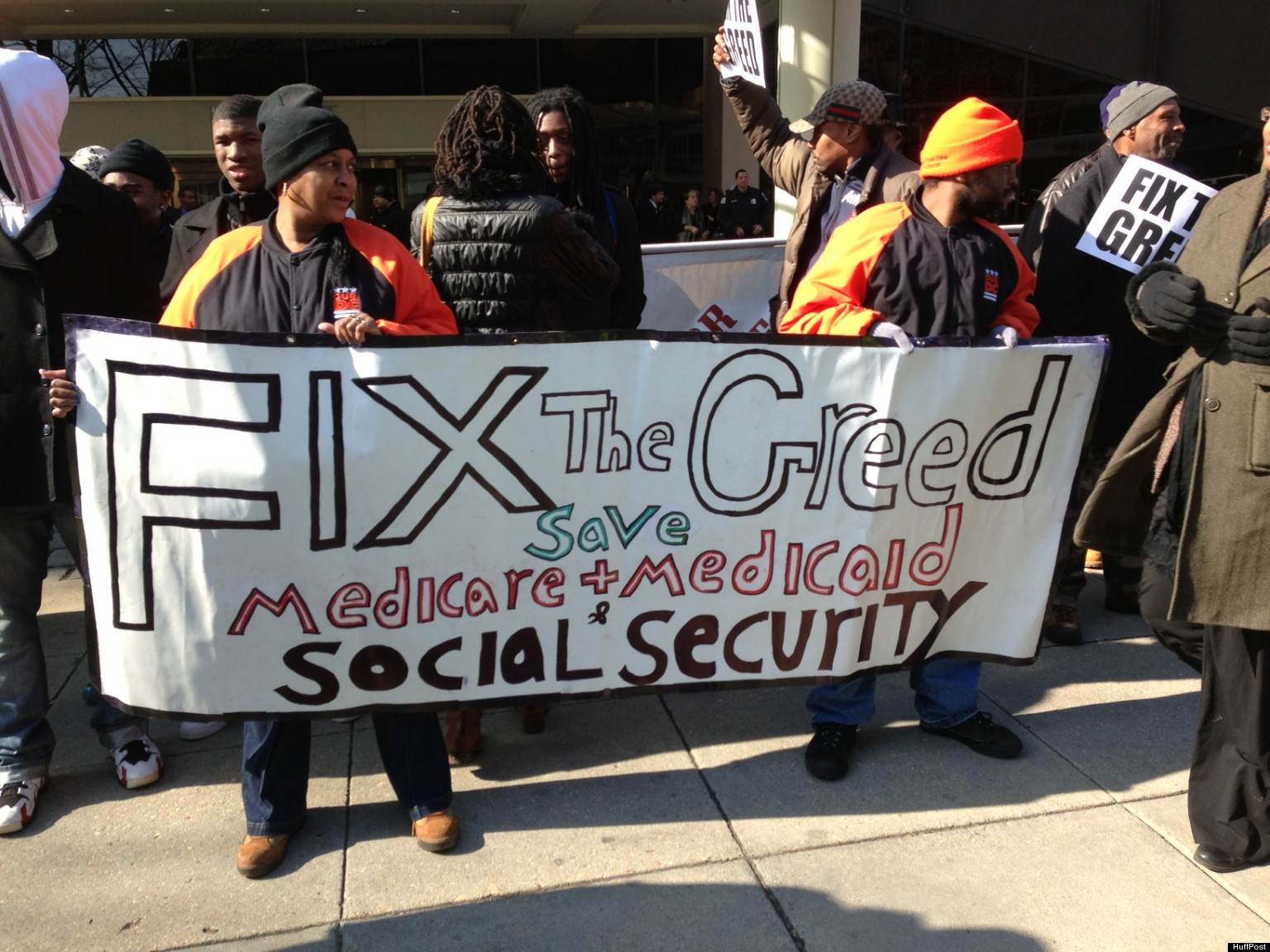

Debt consolidation is a type of loan that rolls several unsecured debts into one single bill, usually to get a lower interest rate. Cutting down expenses, such as streaming services, ordering delivery. National debt that go beyond raising taxes and cutting discretionary spending.

Highest interest rate method this approach focuses on your debts like credit card and student. The bottom line. Instead of just putting extra money toward any of your debt, think about which debt you.

Stop your credit card spending. Getting a handle on your income and expenses can you help you figure out if you have any extra. Take advantage of balance transfers.

Create a list of everything you owe, including credit card debt and all other monthly bills. There are two basic strategies that can help you reduce debt: The helpline is open monday to friday, 9:30am to 4:30pm.